PE-Owned firm makes the right investments

The Situation

This PE-owned technology company in the fintech space was organized into 4 different businesses, some of which leveraged common resources and technology.

Management reporting focused on sales and gross margin, but there was no visibility to business unit operating profit. There was considerable costs below the gross margin level.

P/E firm wanted to sell the business in the next 18 months, so it was important for the management team to make good investments. The question was, which business unit(s) deserved scarce capital, and were there any business units that the technology firm should shed immediately?

The Solution

Team used strategic profit analysis to bring visibility to the true financial condition of these businesses an aid in investment decisions:

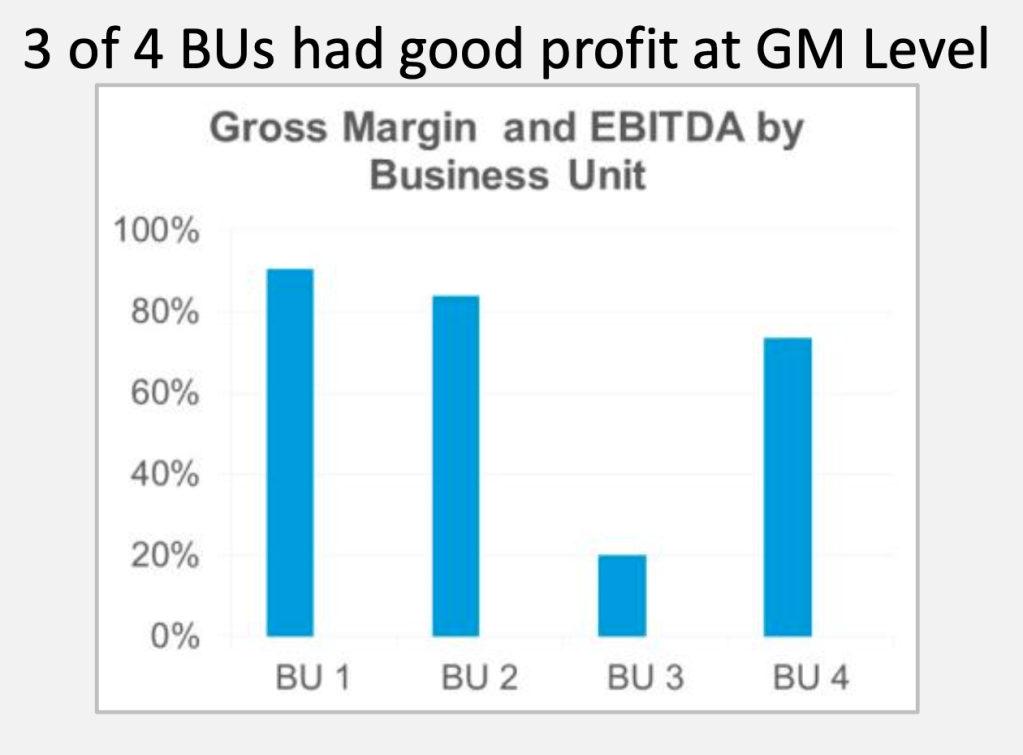

- Analyzed profitability of all 4 businesses

- Modeled cost change/ profit scenarios with variations in volume

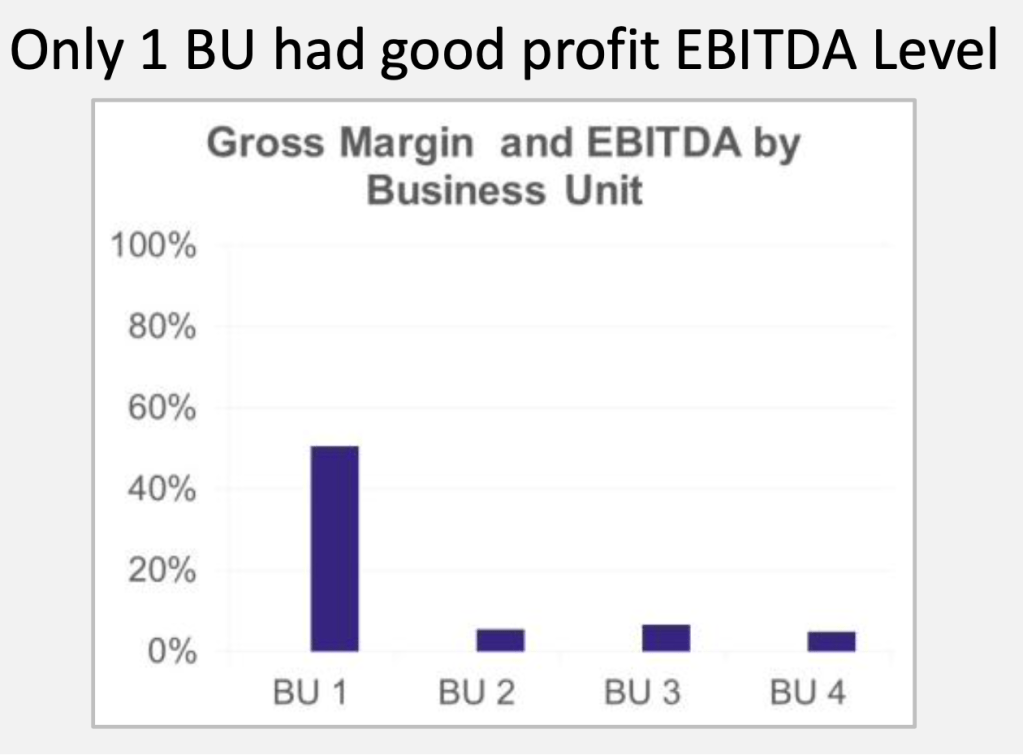

- Revealed that while all BUs had reasonable gross margins, only 1 of the businesses was providing significant operating profit

The Impact

The visibility we provided was significant. Instead of only ~5 points of margin difference between the business units, the management team realized it was 50 points of margin difference. The results drove multiple decisions by the business in advance of the sale, including which businesses needed to focus on cost-cutting, which warranted additional investment, and which could be considered for divestiture.

The result a year later: a successful sale of the company, as hoped for by the P/E firm.